How to Value a Startup?

The valuation of a startup is tricky & challenging. The value of a startup at the moment of the investment is called as Pre-Money — the starting point of a startup on the path of success. Let me brief the major 5 approaches to value a startup. Here we go.

1. Berkus Method

This is one of simplest ways to evaluate & it centres around main 5 key points such as product idea, technologies, team, commercialisation strategies & product roll out. The pre-money valuation should not exceed $2 Million.

Example.

Idea — $ 250,000

Technology- $ 450,000

Team- $ 500,000

Strategy — $ 250,000

Roll out — $ 100,000

Total — $1,550,000

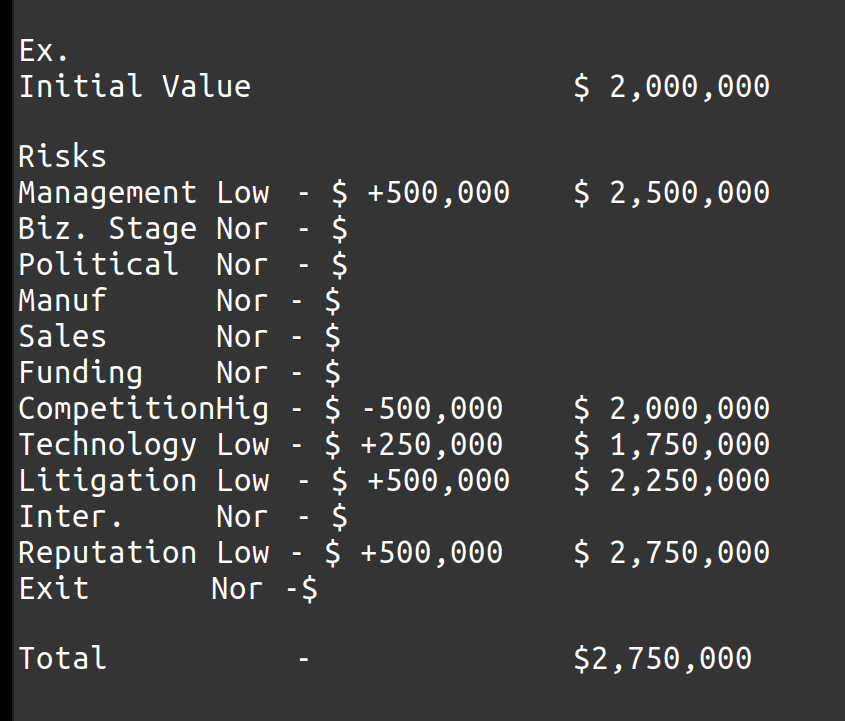

2. Risk Factor Summation (RFS)

Unlike Berkus, it takes 12 key factors into account. Then they are adjusted against its initial value determined earlier.

The initial value is set w.r.t. similar businesses (/around your area). The risk factors are usually set to be the multiples of $ 250,000. Low risk activities are assigned with $ 500,000 & high risk activities below $ 500,000. However, finding the data is the toughest part here.

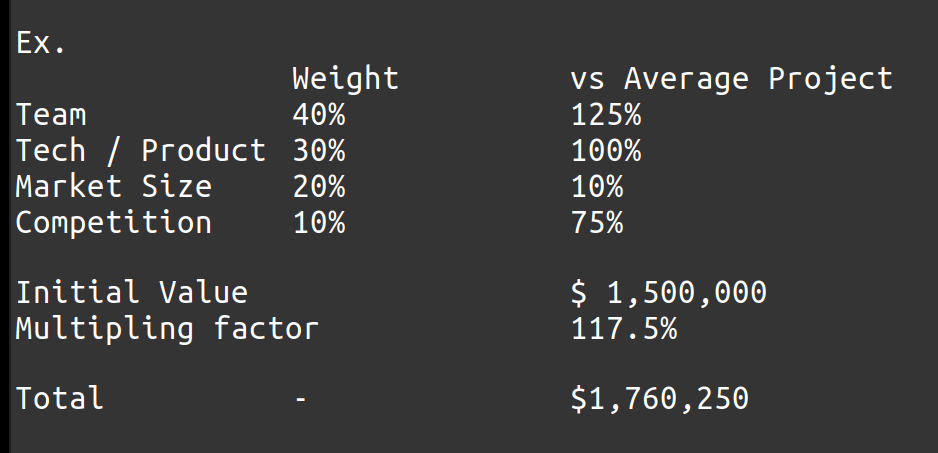

3. Scorecard Valuation Method (SVM)

Similar to RFS, the base initial valuation of the business is set & then the values are adjusted for certain criteria. Unlike the previous method, the criteria are weighed based on their impact on the overall success.

Bill Payne Methods goes beyond the SVM with 6 more criteria such as Management, Opportunity Size Products, Sales Channel, Stage of Business & other factors.

4. Discounted Cash Flow Method

Known as Warren Buffet method, the famous tool to value a startup, it begins with finding the present value (PV) of a startup, by summing all the future cash flow over the next few years.

When building a Discounted Cash flow model, there are 2 major components: (1) the forecast period (n) & (2) the terminal value (TV).

The forecasting period is typically 3–5 years for a normal business. Anything beyond that period becomes a real guessing game, which is where the terminal value comes in.

PV = DCF1 + DCF2 +…+DCFn + TV

There are 2 ways to determine TV.

TV = CFn+1/(r- g)

TV = exit value/(1+r)^n

‘r’ is the discount rate & ‘g’ is the expected growth rate. Next this method is further analysed w/ the probability of achieving the target w.r.t a worst case scenario, a normal case scenario & a best case scenario.

5. Venture Capital Method

This works from the VC’s perspective. A VC generally looks for a specific return on investment such as 10X or 20X, & she expects your startup can be sold for $100 million in 8 years. Then she determines her investment based on the above calculations.

Appreciated Exit — $ 100 M

Target ROI — 20X

Post Money valuation — 100/20 = $5 M

investment — $ 1M

Pre-Money valuation — $ 4M

What if the investors anticipate the need for subsequent investment?

Anticipated Dilution — 30%

Pre Money Valuation — $ 2.8M

(post dilution)

There are many other ways to evaluate a startup. However, these are the mainly used tools among investors.

Intellectual Property Valuation

Unlike startup valuation, IP valuation are normally done as follows

(i) Income Method: Future projected cash flows related to the IP.

(ii) Market Method: IP valuation based on the observations of actual 3rd party transactions of comparable IP.

Comments

Post a Comment